Add comparable sales to the list of things Millennials have killed.

We joke, of course, but the truth is Millennial – And yes, Gen Z – homebuyers have a way of thinking and behaving that is far different from what industry veterans are used to.

It could be argued that this behavior is market-driven. To illustrate this point, Here’s the story of one Millennial homebuyer’s process.

Recently Jared Preisler’s (DataMaster’s Chief Appraiser) son, Taylor, graduated from med school and was on the hunt for his first home. Taylor’s methodology and consequential selections surprised Jared, who is nearing his 27th year as an appraiser.

Jared gleaned his own findings from the home-buying process, including a new approach to the initial home search, how “comparable” may not mean “competing,” and the role that appraisal technology plays as demographics change. We’ll touch on each of those takeaways, but first, let’s dive into Taylor’s journey.

Millennial Homebuyers Do Their Homework

Taylor fits a popular home-buying demographic: Millennial, married, and college-educated. According to the National Association of Realtors’ 2023 Home Buyers and Sellers Generational Trends Report, Millennials have made up the largest share of homebuyers from 2014 to 2022. Across all generations, 58% of homebuyers had obtained a bachelor’s degree or higher, and 61% of all buyers were married couples.

And while this article will mainly focus on Millennials in reference to first-time homebuyers – 70% of Younger Millennials (ages 24 to 32) and 46% of Older Millennials were first-time homebuyers, according to NAR’s 2023 report – it’s worth noting that Gen Z has entered the market. According to NAR, Americans between the ages of 18 to 23 made up 4% of buyers and sellers. All of that to say, as an appraisal professional, these demographics are huge, and understanding these generations and their home-buying behaviors is crucial moving forward.

Back to Taylor. It was an understatement to say “college educated.” Taylor’s home search began upon his graduation from med school and the start of his residency at a St. Louis hospital. After years of renting a smaller apartment, his wife had one requirement: More than one bathroom. For Taylor (and homebuyers like him), proximity to work was top of the list.

To get a geographic sense of where they could live, Taylor used Google Maps and set the directions to different times of day to see how long his commute would be.

“He’s using these tools, which, to me, was very interesting,” Jared said. “As an appraiser, I never really thought about that. And I said, ‘So does it matter which side of the freeway you’re on?’ To which Taylor replied, ‘No, it really doesn’t matter.'”

“But to me as the appraiser I would have said, ‘Well, there’s probably a difference between north side of the freeway and south side of the freeway, or east side and west side,’ because appraisers are taught that these major thoroughfares can be dividers of markets.”

A Homebuyer's Competing Properties May Not Equal Comparable Properties

Ultimately, for Taylor and his wife, living in a specific named neighborhood was not much of a consideration, provided that the home was close to the hospital of his residency. They worked with a real estate agent, who confirmed to Jared that the method by which Taylor was searching for a home was not a one-off. Price tag and proximity are the critical determinants for many of her clients, with minimal focus on neighborhoods.

Eventually, Taylor and his wife narrowed down the list of 25 properties to four.

“I looked at the four houses that they had picked, and I would not have used any of the four as comparables in my appraisal against any of the other houses,” Jared said. “They were so different from each other and I’m thinking, ‘How, if my son is the market, how could that be?'”

Of the four houses, one was built in 1908, and another was built in the 1970s. Homes ranged from one-story to two-stories, off-street parking to carports, with and without basements. To a long-time appraiser like Jared, there was almost no rhyme or reason to these selections.

“None of them, to me, would have come into my search as a comparable for the other one, yet to my son, they were all competing properties,” Jared explained. “…This was a real eye-opener to me to try to understand buyers. And I think it’s a good exercise for appraisers, to every once in a while, get out there, ride along with a real estate agent and see what the market is doing.”

“If nothing else, pause for a minute, you’re looking at the subject property and say, ‘Who are homebuyers that would be most likely to buy this property? And what are other properties that would fit their needs,'” Jared said.

Taylor and his wife have since selected and closed on one of the homes from their list of four. When it came time for the appraisal, none of the six comparables in the appraisal report were any of the other three houses that they had narrowed it down to. Even weeks later, Jared is still reflective about what he, as an appraiser, should learn from this. His main takeaway? Stay in touch with the market and its changing homebuyer demographics.

“I think that most appraisers are like me. I think the average appraiser in America is 60 years old and doesn’t have a mortgage on his house, because we bought our houses 25 or 30 years ago,” Jared said. “And we can lose touch a little bit with what the market is right now. What are truly relevant characteristics for today’s homebuyers?”

Appraisal Technology Can Help Appraisers Navigate Change

Introspection, like what Jared went through, is a healthy practice for appraisers. By looking through the lens of a first-time homebuyer, he discovered methods of home searching and ways of thinking that may have not otherwise occurred to him. Being able to think like today’s homebuyers is a vital skill for appraisers to hold on to.

And as an appraiser, you don’t have to sharpen this skillset on your own.

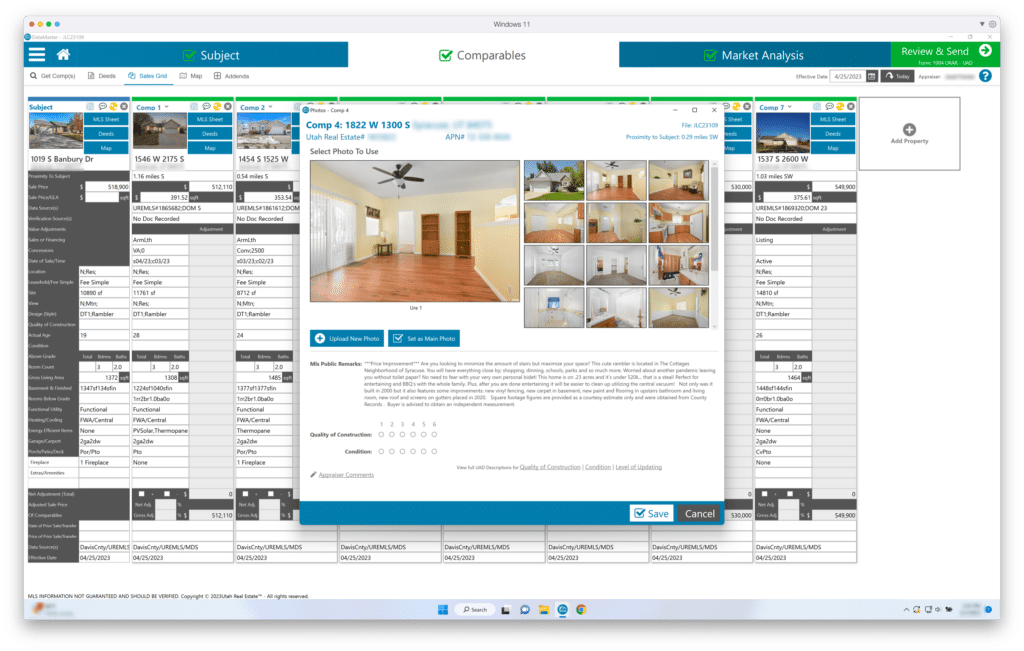

Thankfully, as homebuyer behavior changes, appraisal technology is continually adapting to help appraisers. In situations like Taylor’s, an appraiser could employ DataMaster to obtain two different data sets for the two priorities the family had: Proximity to work and two bathrooms.

With DataMaster, appraisers could draw a map of 20 minutes around the hospital and get all the sales in that particular area and put them into neighborhood analysis. They could then have DataMaster pull up all of the homes with two bathrooms within that map and compare them.

“Then I see if they are increasing at the same rate, and if the days on market are the same,” Jared said. “‘Is the price per square foot the same?’ ‘Are these typically larger homes or smaller homes than the larger/broad market?'”

“And as the appraiser, I now have this data-driven decision tool that helps me analysis the market.” Jared said. “I can use technology to help me get out of the ruts that we sometimes get in as appraisers, understanding and using the technology helps me to analysis the market from a data perspective, support my decisions leading to more credible reports.”

The Bottom Line

As markets and demographics change, homebuyer behavior is sure to change with it.

As appraisers, it is our job to stay in touch with how these behaviors can impact our practice. Today’s buyers may not think the way you think, and that’s okay! We can learn a lot from how today’s homebuyers use technology to find information and make choices. With the correct toolkit and a willingness to adapt, you can be ready for whatever the next wave of homebuyers throws at you.

Have you noticed any ways homebuyers use tools and technology to make decisions? Drop a comment below.

Subscribe Now

If you want to keep up-to-date with what’s happening with DataMaster sign up for our newsletter!